are inherited annuity distributions taxable

The earnings on an inherited annuity are taxable. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds.

Inheritance Annuities Know Your Annuity Contract Transamerica

The bait and switch.

. The earnings are taxable over the life of the payments. So both my mom and I inherited separate annuity accounts from my dads death life insurance policies that were annuity accounts. When you inherit an annuity the tax rules are similar to everything described above.

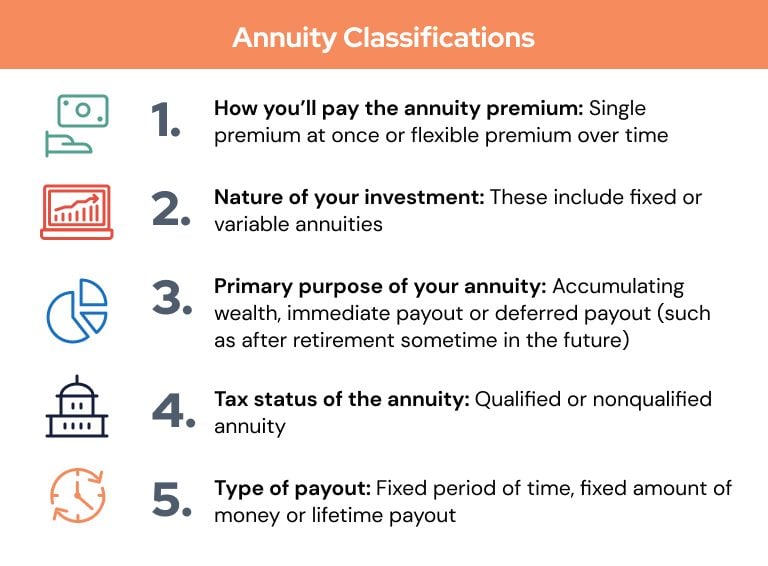

You are also required to take distributions from the annuity pursuant to the applicable required minimum distribution RMD rules. You started taking required minimum distributions from the inherited IRA in 2019 when you were age 55 using a life expectancy of 296 and reducing that number by 1 each year so that in 2022. There are three main ways beneficiaries can receive inherited annuity payments.

Inherited Annuity Payout Options. If you dont this will be treated as a fully taxable distribution just like any other fund from a non-qualified annuity. Inherited annuities are taxable as income.

Inherited annuities are taxable as income. Are inherited annuity distributions taxable. Lets look more closely at how much you have to pay in taxes on an inherited annuity.

How inherited annuities are taxed depends on their payout structure and whether the one inheriting the annuity is the surviving spouse or. This also applies to. If you opt to receive a lump-sum payment of all.

The beneficiary of a tax-deferred annuity may choose from several payout options which will determine how the income benefit. You live longer than 10 years. Unfortunately gains are distributed.

IRA Beneficiaries Inherited from spouse. If you inherit an annuity you may have to pay taxes on your money. Annual payments of 4000 10 of your original investment is non-taxable.

If youre younger than 59 ½ and. Ddemarino The federal tax on the distribution would. But even a series of five equal distributions has tax drawbacks.

If you inherit a non-qualified annuity the method by which you choose to withdraw the funds will determine how you are taxed. Beneficiaries of a retirement account or traditional IRA must include in their gross income any taxable distributions they receive. A lump-sum distribution allows the.

Whoever inherits the new unacceptable annuity will have to pay taxes associated with the withdrawal of income but not the main liability like the original owner. Inherited Non-Qualified Annuity Taxes. Different rules apply For most types of property income taxes on an.

Taxation of distributions from qualified plans and 403b annuities is complex and. An annuity is a financial product that can be passed down from one generation to another. An annuity normally includes both gains and non-taxable principal.

You have an annuity purchased for 40000 with after-tax money. Qualified annuity distributions are fully taxable.

Tax Deferral Of Variable Annuities May Cause More Tax

Are Annuity Tax Benefits Taxable How Are Benefits Paid Out

Know Your Inherited Annuity Options To Discover The Tax Savings

Annuity Beneficiary Learn Payout Structure Death Benefits More

Variable Annuities Taxes Match With A Local Agent Trusted Choice

Leaving Nonqualified Annuity For Child Will She Owe Tax

Annuity Taxation How Various Annuities Are Taxed

Annuities Explained Information Annuity Basics

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

Annuity Taxation How Are Annuities Taxed

Making Annuity Inheritances More Tax Efficient

Mom Is Worried About Tax Hit From Annuity

Inherited Annuity What Are My Choices

How Are Inherited Annuities Taxed Annuity Com

Layin It On The Line How Are Inherited Annuities Taxed St George News

Inherited Annuity Beneficiary Options

Publication 575 2021 Pension And Annuity Income Internal Revenue Service